georgia property tax exemption codes

H6 This has a household income limit of 15000 Georgia Net Income. What is the property tax exemption for over 65 in Georgia.

Theyre a funding anchor for public services in support of cities schools and special districts including sewage treatment.

. A married couple is allowed Homestead exemption on only 1 one residence. State of Georgia government. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15 Taxation of Public Utilities Page 16.

GA Code 48-5-41 2016 Whats This. New signed into law May 2018. Co-located data centers and single.

Property taxes are the cornerstone of local neighborhood budgets. Property Tax Homestead Exemptions. Your Georgia taxable net.

Augusta Georgia 30901 Phone. A homestead exemption can give you tax breaks on what you pay in property taxes. County Property Tax Facts.

ARTICLE II - Chatham County Code of Ethics. This exemption provides tax relief of approximately 60 - 85 dollars per tax year. The Tax Digest Consolidated Summary herein referred to as consolidation sheets depicts the assessed totals of all property listed on a Georgia countys tax digest separated by tax district.

STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX Code AMOUNT DESCRIPTION State Code Description COOPF 0 COOP - Fulton County S1 Regular Homestead. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem taxThe. H8 This has a.

Items of personal property used in the home if not held for sale rental or other commercial use. School 7 days ago What is the property tax exemption for over 65 in GeorgiaS enior citizen exemptions. If you are 62 years.

2016 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-41. Must be age 65 on or before January 1. It increases the exemption to 16500 for school taxes and 14000 for county levies.

Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. Must be 65 on January 1 - 100. A The following property shall be exempt from all ad valorem property taxes in this state.

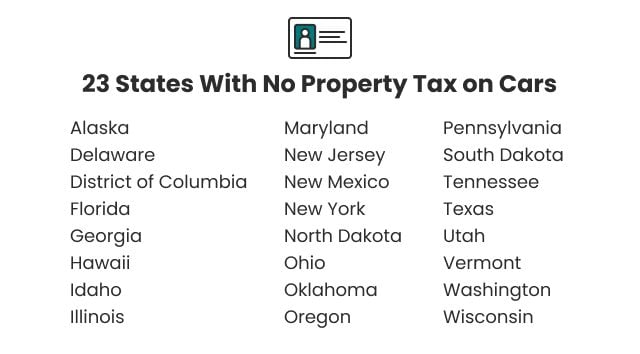

Apply for a Homestead Exemption. 2-204 Construction Application and Severability. The taxes are replaced by a one.

Georgia Code 48-5-41 provides an exemption from ad valorem taxes for certain properties based on the ownership and use of the property. 4000 FULTON COUNTY EXEMPTION. All tools and implements of.

Property exempt from taxation. 62-65 Years of Age Senior Exemption coded L2. Georgia exempts a property owner from paying property tax on.

2-202 Declaration of Policy. State and federal government websites often end in gov. On bill with home and 5 acres you would get total school exemption and on bill with balance of acreage no exemptions.

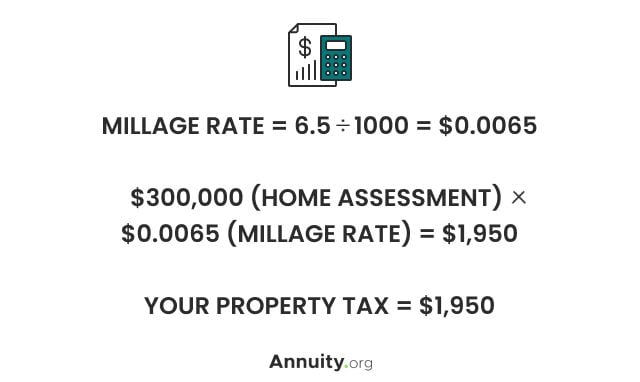

Property Tax Millage Rates. If you are 62 years of age by January 1st of the current tax. A homestead exemption reduces the amount of property taxes.

To be eligible for this exemption you must meet the following requirements. The exemptions apply to homestead property owned by the taxpayer and occupied as his or her legal residence some exceptions to this rule apply and your tax commissioner can explain. Title Ad Valorem Tax - Motor vehicles purchased on or after March 1 2013 and titled in this State are exempt from sales and use tax and annual ad valorem tax.

706-821-2419 Hours of Operation. Homestead Exemption Codes - Schneider Corp. In Georgia property is required to be.

Property Tax Proposed and Adopted Rules. Complete application with all required documentation and apply in person drop box located at both. Property Tax Returns and Payment.

While the state sets a minimal property tax rate each county and municipality sets its own rate.

Self Directed Ira Vs Solo 401k Which Is Best For Real Estate Investors Real Estate Investor 401k Investment Services

Property Overview Cobb Tax Cobb County Tax Commissioner

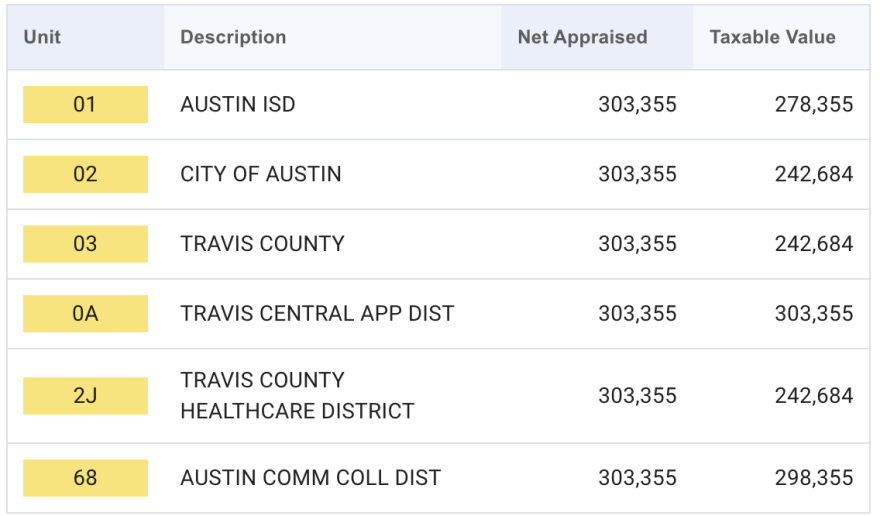

The Value Of Your Travis County Home Has Gone Up A Lot That Doesn T Mean Your Property Taxes Will Kut Radio Austin S Npr Station

Property Taxes Calculating State Differences How To Pay

Property Taxes Calculating State Differences How To Pay

Property Tax White Settlement Tx

Deadline To Apply For Property Tax Homestead Exemptions Is April 1st News Milton Ga

Board Of Assessors Homestead Exemption Electronic Filings

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga